child tax credit september 2020

Expansions to Child Tax Credit Contributed to 46 Decline in Child Poverty Since 2020. The IRS is paying 3600 total per child to parents of children up to five years of age.

Can Self Employed Workers Receive Tax Credits For Covid 19 Goodrx

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if.

. Families who filed a 2019 or 2020 tax return by Monday August 30. September 17 2021 This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. The maximum annual Child Tax Credit rates are shown below.

Part of this credit can be refundable. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. That drops to 3000 for each child ages six through 17.

Ad Receive the Child Tax Credit on your 2021 Return. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Those payments will last through December.

September 13 2022. If youve filed tax returns for 2019 or 2020 or if you signed up. IRS Tax Tip 2020-28 March 2 2020 Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17.

The Child Tax Credit will help all families succeed. In 2020 the two child poverty measures began to diverge due to. It is a partially refundable tax credit if you had earned income of at.

Half of the total is being paid as. The IRS has announced the September child tax credits are on their way and future payment dates. The maximum amount you can claim for the credit is 2000 for each child who qualifies you for the CTC.

To claim the full Child Tax Credit file a 2021 tax return. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. The Additional Child Tax Credit is refundable which.

Rates per year 2022 to 2023. Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to 17. File Federal Taxes to the IRS Online 100 Free.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. Any payments you have already missed will simply. Who is Eligible To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly.

For more information about claiming the. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax. The majority of the time it is equal to the unused portion of the Child Tax Credit up to 15 of your earned income that is more than 3000.

Occupational Health Watch July 2016. While it is too late now to register for the September 15 payment you can still register for free here for future payments. Thats 300 per month 3600 12 for the younger child and 250 per month 3000 12 for the older child.

Child Tax Credit family element. August Is Valley Fever Awareness Month. Learn More at AARP.

Occupational Health Watch September 2016. But see Limits on the CTC and ODC later. List of payment dates for Canada Child Tax Benefit CCTB GSTHST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB.

Yearly Income Guidelines And Thresholds Beyond The Basics

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Cbic Issues Notices To Companies For Itc Refund With Interest Indirect Tax Company Data Analytics

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Credits And Coronavirus Low Incomes Tax Reform Group

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Tds Income Tax Return Itr Due Dates

An Update To The Budget Outlook 2020 To 2030 Congressional Budget Office

Irs Issues Employer Guidance On Covid 19 Paid Leave Tax Credits Cupa Hr

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

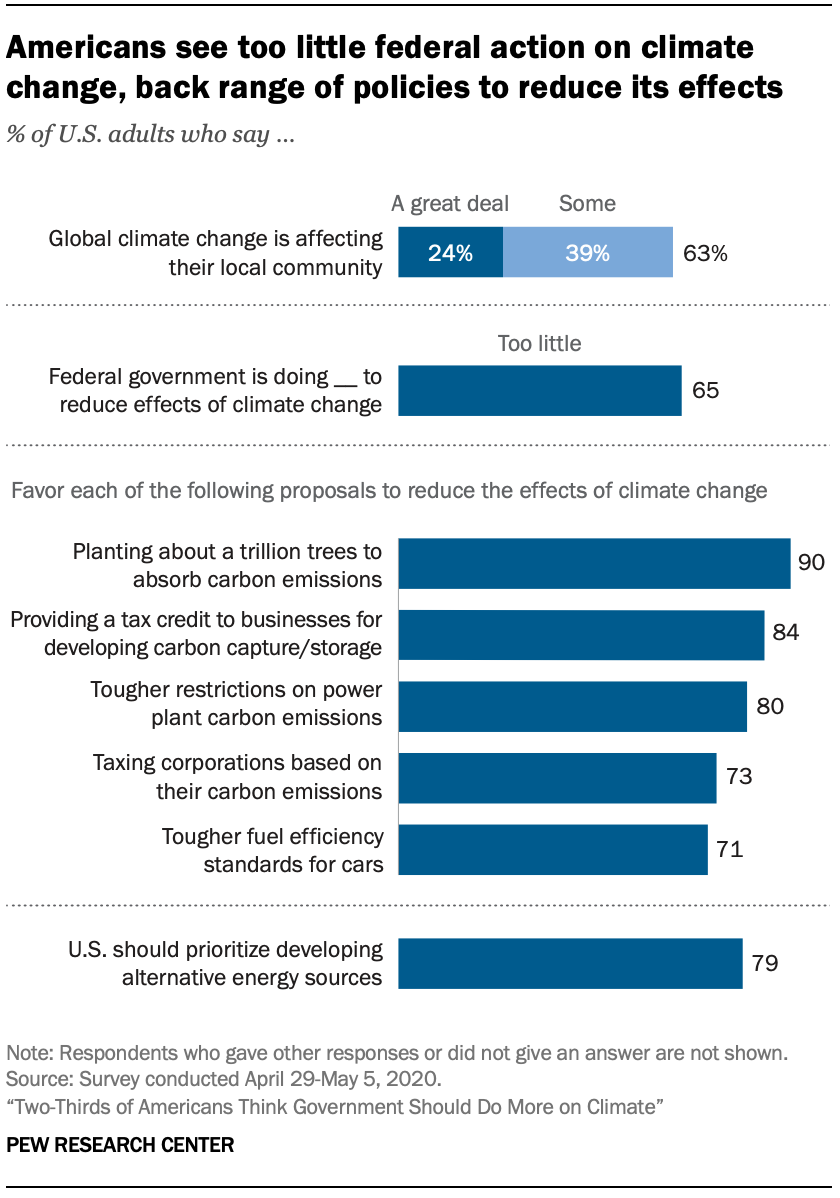

Two Thirds Of Americans Think Government Should Do More On Climate Pew Research Center

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities